Earnings That Stay Untouched by Tax: Legal Ways to Build Exempt Income in India

Not all income in India attracts tax. Under specific provisions of the Income Tax Act, several earnings remain fully or partially exempt if conditions are met. From agricultural income to select investment returns, understanding these avenues can help individuals plan finances more efficiently and lawfully.

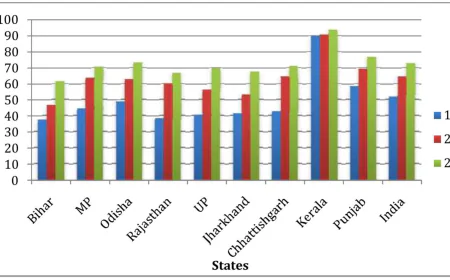

Agricultural Income

Income earned from agricultural activities such as cultivation, sale of produce, and rent from agricultural land is exempt under Section 10(1) of the Income Tax Act. This applies when the land is situated in India and used for agricultural purposes. While it is tax free, it may be considered for rate calculation if the total income crosses certain limits.

Public Provident Fund Returns

Interest earned from investments in the Public Provident Fund enjoys full exemption. The scheme falls under the EEE category, meaning the investment, interest earned, and maturity amount are all tax free, subject to prevailing rules. This makes it a preferred long term savings tool for salaried individuals.

Sukanya Samriddhi Yojana

Designed to support the financial security of a girl child, the Sukanya Samriddhi Yojana offers tax free interest and maturity proceeds. Contributions also qualify for deduction under Section 80C, making it a dual benefit instrument for families.

Life Insurance Proceeds

The maturity amount received from a life insurance policy is exempt under Section 10(10D), provided the premium does not exceed the specified percentage of the sum assured. Death benefits paid to nominees are fully exempt, offering financial protection without additional tax burden.

Tax Free Bonds

Certain government backed bonds issue interest that is exempt from income tax. These bonds are typically offered by public sector undertakings and are popular among conservative investors seeking stable returns without tax liability.

Scholarships and Awards

Scholarships granted to meet the cost of education are fully exempt. Similarly, certain awards and rewards approved by the government may also qualify for exemption, encouraging merit and academic excellence.

Hindu Undivided Family Receipts

Amounts received by a member from a Hindu Undivided Family out of its income are exempt in the hands of the individual, as the HUF is taxed separately.

Gifts Within Limits

Gifts received from specified relatives are not taxable. Additionally, gifts received on the occasion of marriage are fully exempt regardless of value.

Final Thoughts

Tax free income options in India are structured to promote savings, agriculture, family welfare, and social development. However, exemptions often come with conditions and limits. Reviewing eligibility carefully and maintaining proper documentation ensures compliance while maximising legitimate benefits.