Trump's 50% Tariff on India Eviscerates Modi's Russian Oil Math

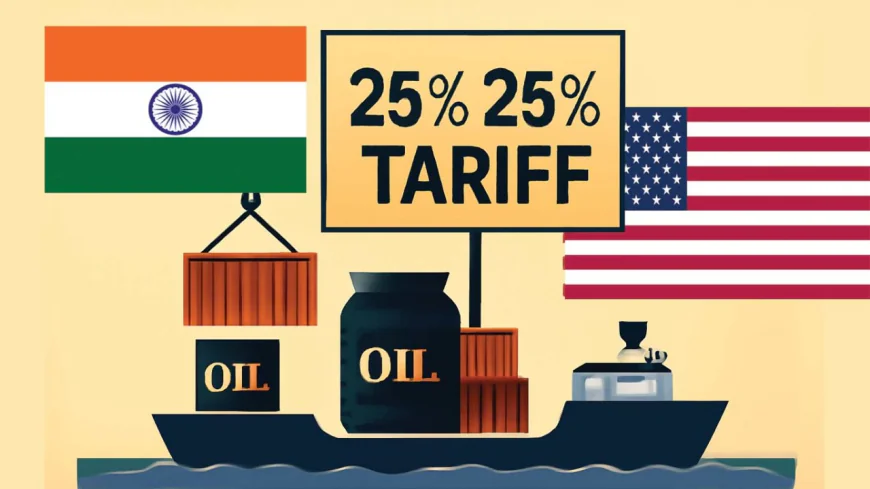

In a shocking development, U.S. President Donald Trump has announced a 50% tariff on Indian merchandise, upending Prime Minister Narendra Modi's long-held policy of using discounted Russian oil for domestic energy and economic gain.

In a shocking development, U.S. President Donald Trump has announced a 50% tariff on Indian merchandise, upending Prime Minister Narendra Modi's long-held policy of using discounted Russian oil for domestic energy and economic gain.

Farewell to “Modi's Russian Oil Math”

In the wake of the Ukraine conflict, India significantly increased its imports of Russian crude that was heavily discounted because of sanctions. This "Russian oil math" allowed New Delhi to stabilize domestic energy costs and enhance refining-export ability. By 2023, India received nearly 40–45% of its crude from Russia, compared to essentially zero in 2021.

But Trump’s imposition of an additional 25% tariff to the already existing 25% is an all-out assault on India's economy. Trump's framing of the action focused on India's continued support of the Russian economy as a national security issue.

Economic Ripples on India

Economists now caution that GDP growth may decline from 0.8% to 1%, with exports to the U.S. (~$87 billion p.a.) expected to be cut 40-60%. With a weakened rupee, collapsing FDI, and a $10 billion outflow from Indian equities, the pressure is building.

Indian refiners, aware of a changing wind, are already winding down Russian crude purchases. State refiners such as Indian Oil Corporation are diversifying into U.S., Brazilian, and Libyan supply sources, in recognition of the current uncertainty and waiting for clearer direction from the Indian government policy-wise.

A Strategic Gamble

This tariff increase places India at a crossroads. On the one hand, it will threaten economic stability; on the other hand, it highlights a delicate geopolitical balancing act of maintaining cordial diplomatic relations with Russia, managing energy security, and protecting domestic farmers and labor. Prime Minister Modi has indicated a commitment to India's farmers and dairy producers, as well as a commitment to the country's broader strategic autonomy even if it is a “price” that has to be paid.

Is the Tariff a Misfire?

Some analysts contend that the move is incredibly blunt. The tariff does not specifically curtail purchasing of Russian oil, but rather targets India’s position as the refining intermediary. Markets have largely regarded this with indifference; the goal to cripple Moscow’s war chest will probably not be met without additional targeted action. Europe’s more surgical sanctions and price-cap mechanisms may be more successful down the line.

What's Next for India?

As India considers the external shock, the country may accelerate energy sourcing changes from the Middle East to the U.S., Brazil, or West Africa, though this change comes at a presumed cost of $9–11 billion per year. Diplomatically, the hope is that India will again try negotiations with the U.S., although it remains unclear where common ground can be found, particularly with India seemingly unwilling to budge on agricultural and dairy changes.

Ultimately, Trump’s tariffs spoiled the careful arithmetic Modi was working with and now India must rethink its energy calculus and where it fits into an increasingly fractured global order.