Indian Corporates Shine in Q1 FY26 with Strong Earnings Across Key Sectors

Indian businesses have kicked off FY26 on a strong note, with several major companies reporting robust Q1 results. Driven by digital transformation, improved consumer demand, and resilient financials, the earnings season reflects underlying strength in the country’s economic recovery.

IT & Tech Services: A Mixed Yet Promising Quarter

Among the most-watched results was that of Wipro, which reported a 7% decline in net profit year-on-year. However, the fall was anticipated, and investors reacted positively due to the company’s focus on cost optimization and future-facing tech solutions. Despite global headwinds, Wipro’s digital and cloud segments remain key growth drivers.

On the other hand, LTIMindtree posted a relatively stable performance. The company reported healthy revenue growth and a strong order book, signaling continued demand for IT outsourcing and transformation services. Analysts believe the firm’s integration process post-merger is on track, boosting operational efficiency.

Banking Sector: Resilient Performance Amidst Tight Margins

Axis Bank delivered a steady performance, with a 1% year-on-year rise in Net Interest Income (NII) to ₹13,559.8 crore. However, asset quality slightly deteriorated, raising some concerns among market watchers. Despite this, the bank’s retail lending growth and improved CASA (Current Account Savings Account) ratio suggest sustained momentum.

The banking sector overall is showing signs of maturity, with focus shifting towards improving operational efficiency and digital infrastructure to reduce long-term costs.

Telecom and Financial Services: Emerging Players Step Up

Jio Financial Services, a newer entrant in the financial ecosystem, surprised analysts with a strong showing in Q1. Backed by the Reliance conglomerate, the company reported healthy growth in digital lending and payment solutions, supported by increasing financial inclusion and mobile-first strategies.

Meanwhile, Tata Communications saw positive traction in its enterprise connectivity and cloud segments. The company’s investments in next-gen network solutions are beginning to pay off, especially as remote and hybrid work models persist.

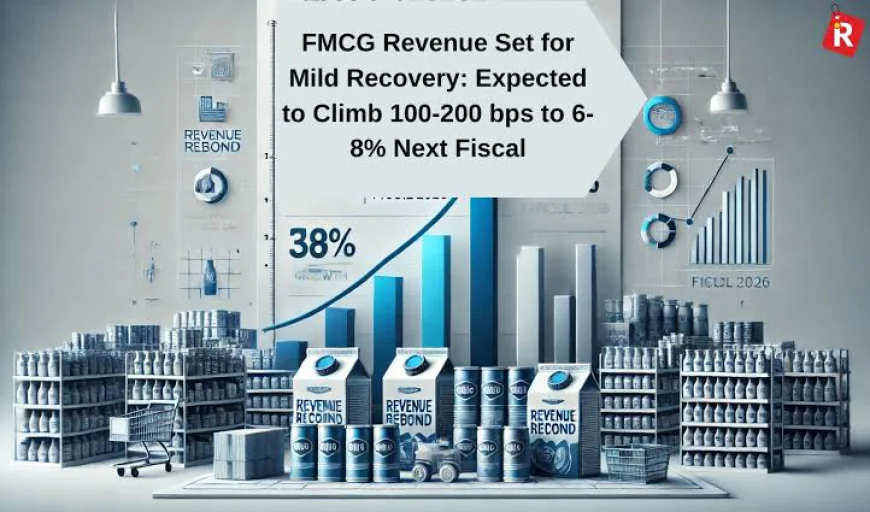

Outlook: Growth Momentum Expected to Continue

The overall sentiment from Q1 earnings is cautiously optimistic. While global uncertainties and inflationary pressures persist, Indian companies particularly in IT, BFSI, and telecom are adapting quickly. The focus now shifts to sustainability, innovation, and digital-led growth as companies brace for the remainder of FY26.

Conclusion:

Q1 results paint a picture of resilience and strategic agility across Indian industries. As corporates continue to navigate global uncertainties, their ability to evolve and innovate will be key to maintaining this momentum.